Wealth simple income tax calculator

Tax saving fixed deposit One can use an income tax calculator to calculate the amount on which the taxes can be saved. You can declare exempt income while filing for income tax every financial year.

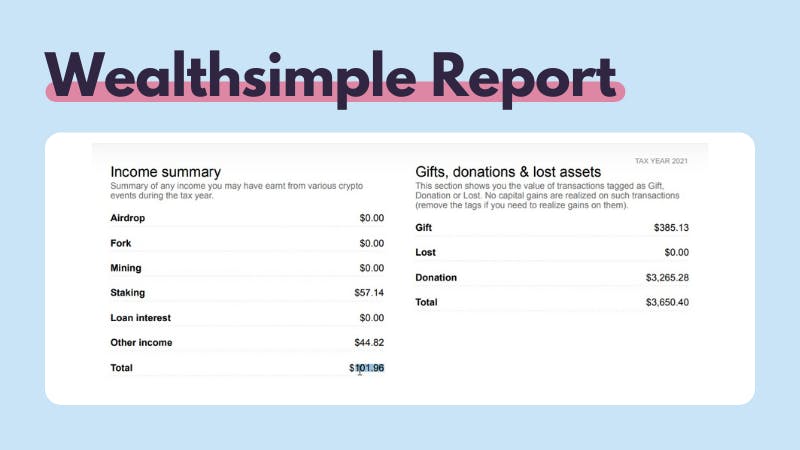

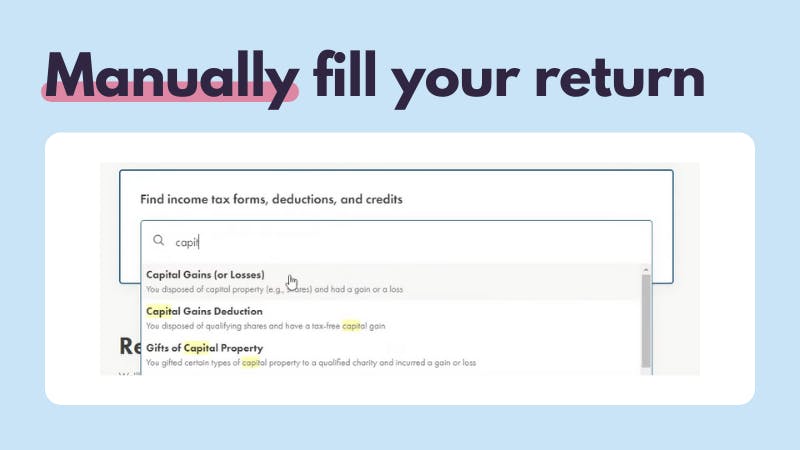

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

Please enter your income deductions gains dividends and taxes paid to.

. Income Tax Calculator - Learn How to Calculate Income Tax Online for FY 2022-23 AY 2023-24 with ICICI Prulifes Income Tax Calculator. Capital Gains Tax Example. ICICI Pru1 Wealth UIN 105L175V03.

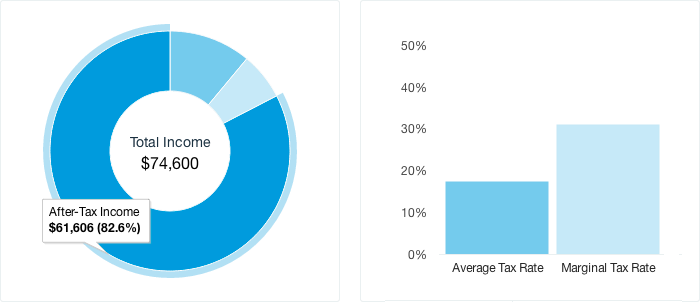

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. Under Income Tax Section 80C and Section 10D New Pension Scheme NPS. All you have to do is take your total earnings add the exempted amounts and.

For salary account holders you need to make a disclosure of exempt income under Schedule S - Details of Income from Salary while filing income tax as per ITR-2. Disclosure of Exempt Income for Salary and Non-Salary Allowances. The monthly Income Benefit and Terminal Benefit may be taxable subject to extra premium being loaded at underwriting stage.

Money is locked in for a period of 15 years although partial withdrawals are permitted the earliest one being after the sixth year. The median after-tax household income in 2022 is 67036 NOTE Statistics Canada reports the 2018 after-tax household income at 61400. P The loan amount.

This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year. A single taxpayer with 1 million in taxable income subject to current tax rates for individuals would pay approximately 334427 in taxes. AY 2023-24 Calculate income tax on your earnings in a few simple steps Basic details.

Top ELSS funds to save tax the smart way. It is simple to understand and can be used by anyone to calculate their tax liability. The tax calculation in Ontario is simple.

I made an assumption of a 3 growth for both 2019 and 2021 to come to 67036. Befiler is Pakistans number one leading tax filing and NTN registration portal for individuals and SMEs. 432664 of Centra Wealth Pty Ltd AFSL 422704.

All one has to do is enter the investment amount. Calculate your Income Tax for FY 2022-23 using Scripboxs Income Tax Calculator under the old and new tax regime at the latest tax slab rate. What is considered a high salary in Canada.

The interest rate on the PPF is linked to the debt market. Simple Interest P x I x N. As per AS-22 Timing differences are the differences between taxable income and accounting income for a period that originate in one period and are capable of.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. By law businesses and individuals must file an income tax. As an example lets say someone earns 50000 in normal taxable income for the year.

N The duration of the loan using the number of periods. Redemption proceeds are tax-free in the hands of investors. Simple interest rate is calculated by multiplying the principal by the interest rate by the number of payment periods over the life of the loan.

This usually happens in late January or early February. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction.

Date of Birth Please enter valid date of birth. The tax calculator is updated yearly once the federal government has released the years income tax rates. Resident provinceterritory Please select Alberta British Columbia Manitoba New Brunswick NewfoundlandLabrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. Heres an example of the governments revenue difference between income tax and a hypothetical wealth tax. Tax benefits are subject to changes in tax laws.

For 2022 this would put a single filer in the 22 marginal tax bracket. Please note that all the tax benefits are subject to tax laws at the time of payment of premium or receipt of policy benefits by you. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

Top liquid funds for lifes surprise expenses. SCSS calculator is very simple and easy to use. I The interest rate.

The capital gains tax calculator uses these numbers to determine the correct amount of tax to pay. Top ELSS funds to save tax the smart way. Tax filing for 2022 - 2023 NTN Registration for 2022 - 2023 Salary Calculator for 2022 - 2023.

2022 free Ontario income tax calculator to quickly estimate your provincial taxes. Taxable income tax loss is the amount of the income loss for a period determined in accordance with the tax laws based upon which income tax payable recoverable is determined. Top liquid funds for lifes.

Wealthsimple Promotion 2022 Get A 75 Cash Bonus Or 10 000 Free

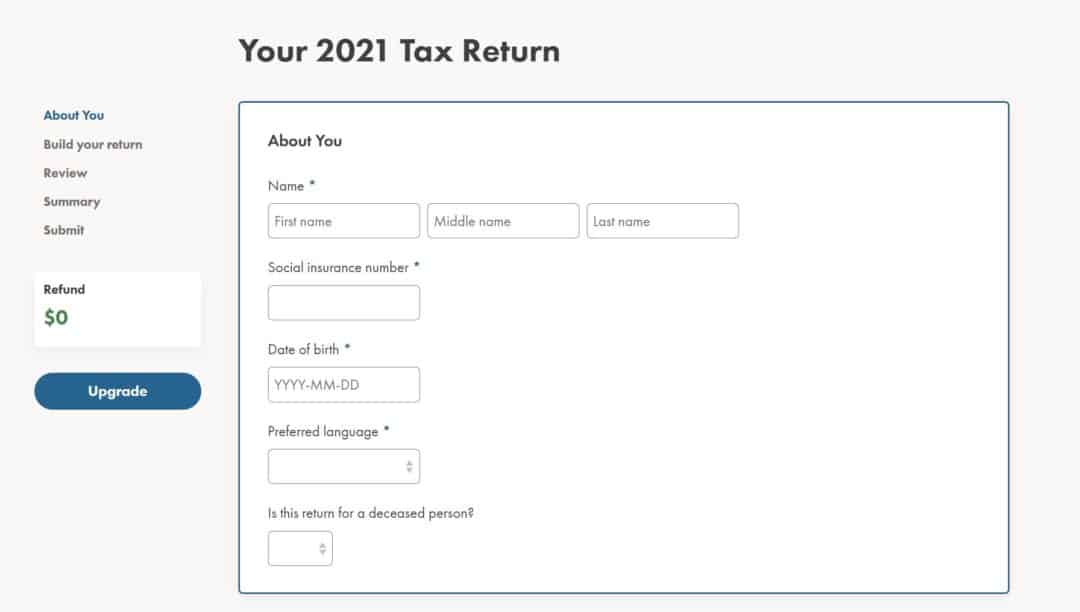

Meet Wealthsimple Tax

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

Wealthsimple Tax Simpletax Review 2022 Savvynewcanadians

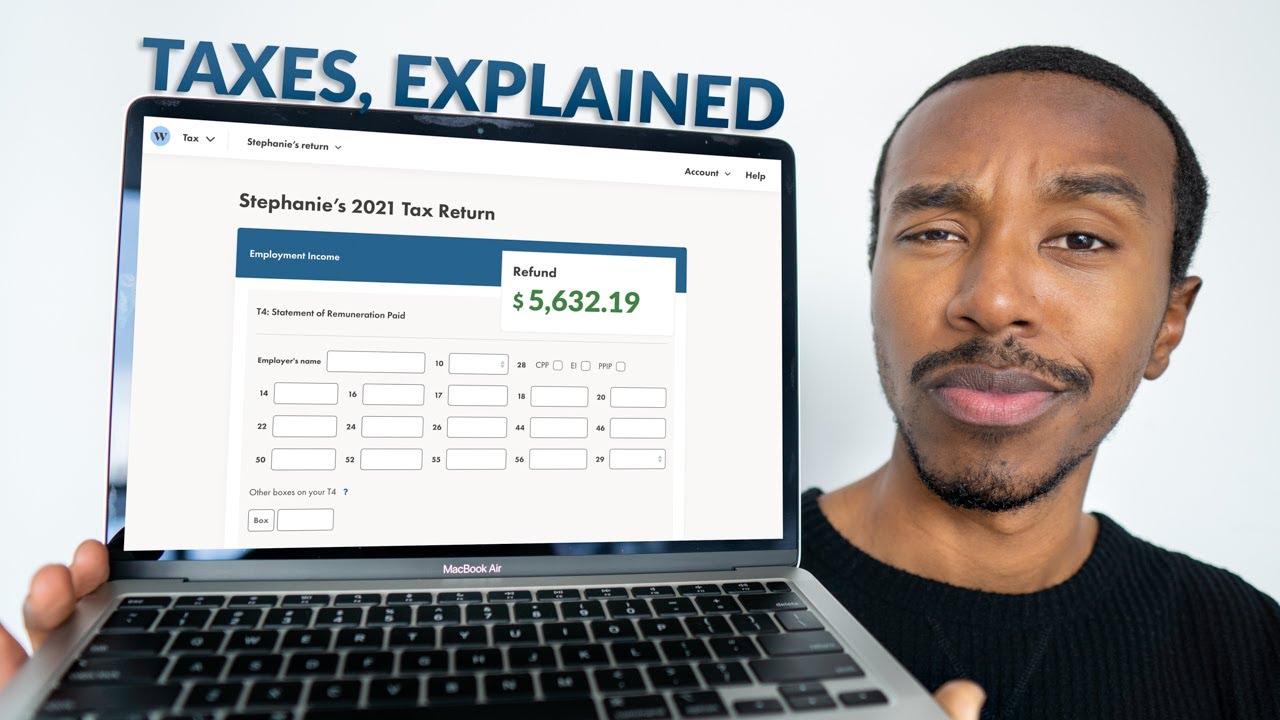

How To Do Your Tax Return For Free How Taxes Actually Work In Canada Wealthsimple Tax Review Youtube

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

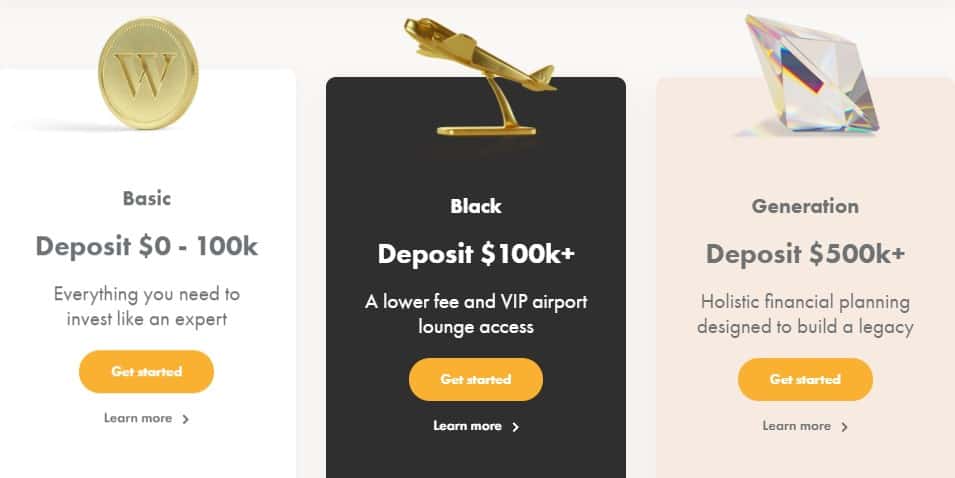

Wealthsimple Review 2022 Investing App For Canadians Fees Pros Cons

Wealthsimple Review Pros Cons Bonus Offer

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

How To Do Your Wealthsimple Crypto Taxes In 2022 Koinly

Wealthsimple Trade Plus Review 2022 Usd Accounts No Commission Trading

What Are Average And Marginal Tax Rates Wealthsimple

Wealthsimple Tax Simpletax Review 2022 Savvynewcanadians

Wealthsimple Tax Simpletax Review 2022 Savvynewcanadians